stock_dimension = len(trade.tic.unique())

state_space = 1 + 2 * stock_dimension + len(INDICATORS) * stock_dimension

print(f"Stock Dimension: {stock_dimension}, State Space: {state_space}")

buy_cost_list = sell_cost_list = [0.001] * stock_dimension

num_stock_shares = [0] * stock_dimension

env_kwargs = {

"hmax": 100,

"initial_amount": 1000000,

"num_stock_shares": num_stock_shares,

"buy_cost_pct": buy_cost_list,

"sell_cost_pct": sell_cost_list,

"state_space": state_space,

"stock_dim": stock_dimension,

"tech_indicator_list": INDICATORS,

"action_space": stock_dimension,

"reward_scaling": 1e-4

}

e_trade_gym = StockTradingEnv(df = trade, turbulence_threshold = 70,risk_indicator_col='vix', **env_kwargs)

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from stable_baselines3 import A2C, DDPG, PPO, SAC, TD3

from finrl.agents.stablebaselines3.models import DRLAgent

from finrl.config import INDICATORS, TRAINED_MODEL_DIR

from finrl.meta.env_stock_trading.env_stocktrading import StockTradingEnv

from finrl.meta.preprocessor.yahoodownloader import YahooDownloader

train = pd.read_csv('train_data.csv')

trade = pd.read_csv('trade_data.csv')

# If you are not using the data generated from part 1 of this tutorial, make sure

# it has the columns and index in the form that could be make into the environment.

# Then you can comment and skip the following lines.

train = train.set_index(train.columns[0])

train.index.names = ['']

trade = trade.set_index(trade.columns[0])

trade.index.names = ['']

if_using_a2c = True

if_using_ddpg = True

if_using_ppo = True

if_using_td3 = True

if_using_sac = True

trained_a2c = A2C.load(TRAINED_MODEL_DIR + "/agent_a2c") if if_using_a2c else None

trained_ddpg = DDPG.load(TRAINED_MODEL_DIR + "/agent_ddpg") if if_using_ddpg else None

trained_ppo = PPO.load(TRAINED_MODEL_DIR + "/agent_ppo") if if_using_ppo else None

trained_td3 = TD3.load(TRAINED_MODEL_DIR + "/agent_td3") if if_using_td3 else None

trained_sac = SAC.load(TRAINED_MODEL_DIR + "/agent_sac") if if_using_sac else None

stock_dimension = len(trade.tic.unique())

state_space = 1 + 2 * stock_dimension + len(INDICATORS) * stock_dimension

print(f"Stock Dimension: {stock_dimension}, State Space: {state_space}")

buy_cost_list = sell_cost_list = [0.001] * stock_dimension

num_stock_shares = [0] * stock_dimension

env_kwargs = {

"hmax": 100,

"initial_amount": 1000000,

"num_stock_shares": num_stock_shares,

"buy_cost_pct": buy_cost_list,

"sell_cost_pct": sell_cost_list,

"state_space": state_space,

"stock_dim": stock_dimension,

"tech_indicator_list": INDICATORS,

"action_space": stock_dimension,

"reward_scaling": 1e-4

}

e_trade_gym = StockTradingEnv(df = trade, turbulence_threshold = 70,risk_indicator_col='vix', **env_kwargs)

# env_trade, obs_trade = e_trade_gym.get_sb_env()

df_account_value_a2c, df_actions_a2c = DRLAgent.DRL_prediction(

model=trained_a2c,

environment = e_trade_gym) if if_using_a2c else (None, None)

df_account_value_ddpg, df_actions_ddpg = DRLAgent.DRL_prediction(

model=trained_ddpg,

environment = e_trade_gym) if if_using_ddpg else (None, None)

df_account_value_ppo, df_actions_ppo = DRLAgent.DRL_prediction(

model=trained_ppo,

environment = e_trade_gym) if if_using_ppo else (None, None)

df_account_value_td3, df_actions_td3 = DRLAgent.DRL_prediction(

model=trained_td3,

environment = e_trade_gym) if if_using_td3 else (None, None)

df_account_value_sac, df_actions_sac = DRLAgent.DRL_prediction(

model=trained_sac,

environment = e_trade_gym) if if_using_sac else (None, None)

##### Mean Variance Optimization

def process_df_for_mvo(df):

return df.pivot(index="date", columns="tic", values="close")

# Codes in this section partially refer to Dr G A Vijayalakshmi Pai

# https://www.kaggle.com/code/vijipai/lesson-5-mean-variance-optimization-of-portfolios/notebook

def StockReturnsComputing(StockPrice, Rows, Columns):

import numpy as np

StockReturn = np.zeros([Rows-1, Columns])

for j in range(Columns): # j: Assets

for i in range(Rows-1): # i: Daily Prices

StockReturn[i,j]=((StockPrice[i+1, j]-StockPrice[i,j])/StockPrice[i,j])* 100

return StockReturn

StockData = process_df_for_mvo(train)

TradeData = process_df_for_mvo(trade)

TradeData.to_numpy()

#compute asset returns

arStockPrices = np.asarray(StockData)

[Rows, Cols]=arStockPrices.shape

arReturns = StockReturnsComputing(arStockPrices, Rows, Cols)

#compute mean returns and variance covariance matrix of returns

meanReturns = np.mean(arReturns, axis = 0)

covReturns = np.cov(arReturns, rowvar=False)

#set precision for printing results

np.set_printoptions(precision=3, suppress = True)

#display mean returns and variance-covariance matrix of returns

print('Mean returns of assets in k-portfolio 1\n', meanReturns)

print('Variance-Covariance matrix of returns\n', covReturns)

##### Use PyPortfolioOpt

from pypfopt.efficient_frontier import EfficientFrontier

ef_mean = EfficientFrontier(meanReturns, covReturns, weight_bounds=(0, 0.5))

raw_weights_mean = ef_mean.max_sharpe()

cleaned_weights_mean = ef_mean.clean_weights()

mvo_weights = np.array([1000000 * cleaned_weights_mean[i] for i in range(len(cleaned_weights_mean))])

LastPrice = np.array([1/p for p in StockData.tail(1).to_numpy()[0]])

Initial_Portfolio = np.multiply(mvo_weights, LastPrice)

Portfolio_Assets = TradeData @ Initial_Portfolio

MVO_result = pd.DataFrame(Portfolio_Assets, columns=["Mean Var"])

##### Part 4: DJIA index

TRAIN_START_DATE = '2009-01-01'

TRAIN_END_DATE = '2020-07-01'

TRADE_START_DATE = '2020-07-01'

TRADE_END_DATE = '2021-10-29'

df_dji = YahooDownloader(

start_date=TRADE_START_DATE, end_date=TRADE_END_DATE, ticker_list=["dji"]

).fetch_data()

df_dji = df_dji[["date", "close"]]

fst_day = df_dji["close"][0]

dji = pd.merge(

df_dji["date"],

df_dji["close"].div(fst_day).mul(1000000),

how="outer",

left_index=True,

right_index=True,

).set_index("date")

##### Part 5: Backtesting Results

df_result_a2c = (

df_account_value_a2c.set_index(df_account_value_a2c.columns[0])

if if_using_a2c

else None

)

df_result_ddpg = (

df_account_value_ddpg.set_index(df_account_value_ddpg.columns[0])

if if_using_ddpg

else None

)

df_result_ppo = (

df_account_value_ppo.set_index(df_account_value_ppo.columns[0])

if if_using_ppo

else None

)

df_result_td3 = (

df_account_value_td3.set_index(df_account_value_td3.columns[0])

if if_using_td3

else None

)

df_result_sac = (

df_account_value_sac.set_index(df_account_value_sac.columns[0])

if if_using_sac

else None

)

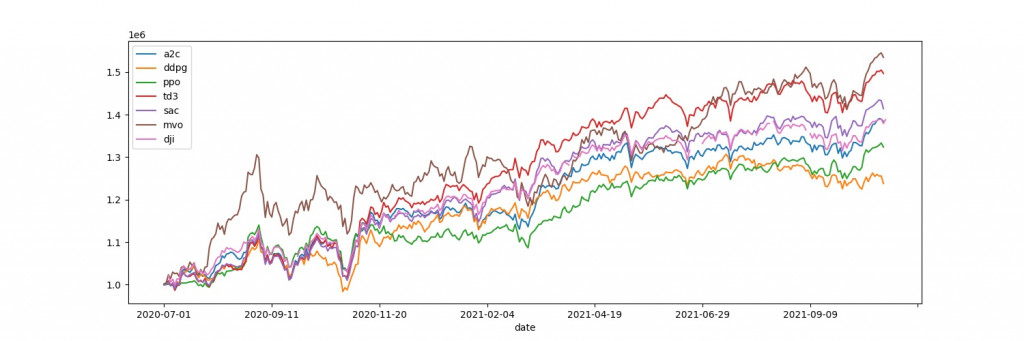

result = pd.DataFrame(

{

"a2c": df_result_a2c["account_value"] if if_using_a2c else None,

"ddpg": df_result_ddpg["account_value"] if if_using_ddpg else None,

"ppo": df_result_ppo["account_value"] if if_using_ppo else None,

"td3": df_result_td3["account_value"] if if_using_td3 else None,

"sac": df_result_sac["account_value"] if if_using_sac else None,

"mvo": MVO_result["Mean Var"],

"dji": dji["close"],

}

)

print(result)

plt.rcParams["figure.figsize"] = (15,5)

plt.figure()

result.plot()

plt.savefig("result_plot.png") # 保存圖像為PNG文件

將所有DRL的績效與MVO與DJI的績效畫在同一張圖中,圖中的Y軸是Account Value (投入總額為1)